Online shopping offers a wide range of payment options, but certain methods you might use in-person aren’t always accepted on the internet. Knowing which payment options are generally not accepted online can help you prepare ahead of time, ensuring a smoother checkout experience. Here’s a guide to common payment options that aren’t usually accepted for online transactions, along with alternative methods you can use.

1. Cash Payments

Cash is the most common form of payment in physical stores, but it’s not accepted for online purchases. Since online shopping requires digital transactions, cash payments are impossible without a face-to-face exchange.

Why Cash Isn’t Accepted Online:

- Cash requires physical presence, which goes against the convenience of online shopping.

- Online transactions rely on digital verification to confirm and authorize payments instantly.

Alternative: Use a debit card, credit card, or other digital payment method for online shopping.

2. Checks (Personal and Paper Checks)

While checks were once popular for various payments, they aren’t typically accepted for online purchases. Personal checks require a manual verification process, which makes them incompatible with instant online transactions.

Why Checks Aren’t Accepted Online:

- Checks must be physically processed and verified, delaying payment confirmation.

- There’s a risk of bounced checks, making checks less secure for online merchants.

Alternative: Use an electronic check (eCheck) if available. eChecks provide similar functionality through direct bank transfers and are accepted by some online merchants.

3. Money Orders

Money orders are another payment option that is almost exclusively accepted in person or via mail. Since they must be purchased and physically submitted, money orders don’t work for online purchases that require immediate payment confirmation.

Why Money Orders Aren’t Accepted Online:

- Money orders require physical delivery, making them too slow for most online transactions.

- Processing fees and delays make them inconvenient for online shopping.

Alternative: Consider using a prepaid card or debit card instead. Prepaid cards function like a credit card but are loaded with a specific amount, offering a similar pay-ahead option as a money order.

4. Bank Transfers (in Some Cases)

Direct bank transfers are accepted by some online retailers but not all. Since bank transfers can involve additional steps, such as verification codes and waiting periods, many e-commerce sites choose not to support them due to potential delays and security concerns.

Why Some Bank Transfers Aren’t Accepted:

- Bank transfers often require a manual approval process, slowing down order processing.

- Certain banks may have regional restrictions, limiting online compatibility.

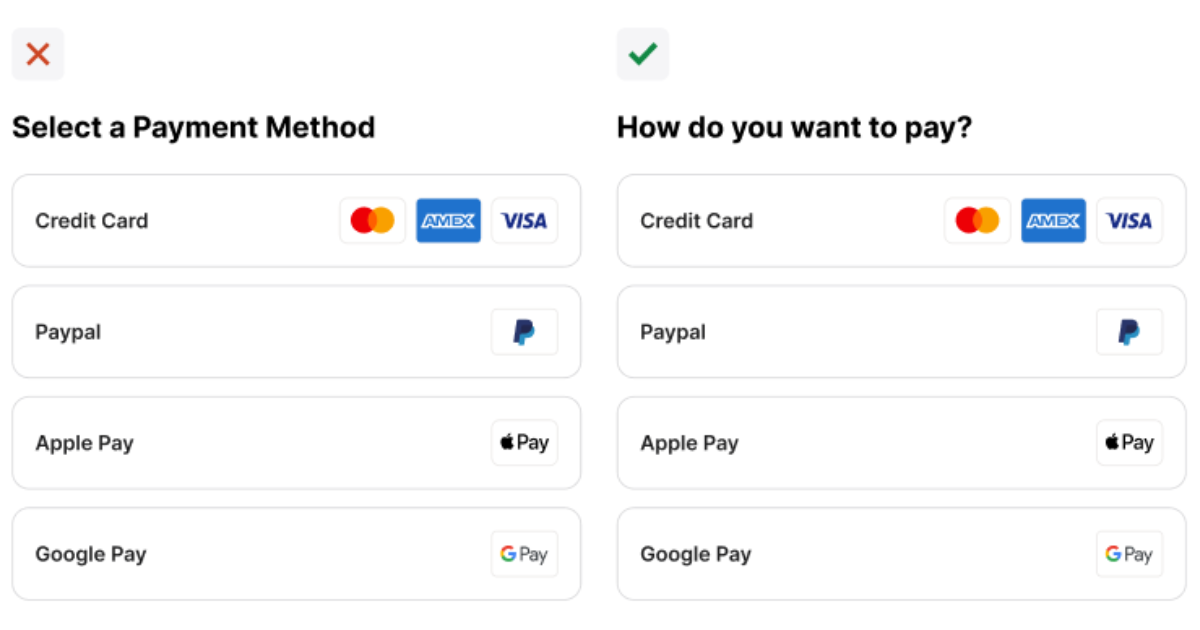

Alternative: If a direct bank transfer isn’t accepted, consider using an e-wallet like PayPal, Apple Pay, or Google Pay, which link directly to your bank account for fast and secure online payments.

5. Barter or Trade-In Services

While bartering was historically a common method of exchange, it’s rarely accepted for online purchases. Bartering relies on an in-person exchange of goods or services, which isn’t feasible on most online platforms.

Why Barter Isn’t Accepted Online:

- E-commerce platforms require standardized payment methods for efficiency.

- Verifying and matching goods for barter is complex in an online setting.

Alternative: Use gift cards or rewards points. Some online stores offer trade-in or credit programs, but these are generally limited to specific goods and services.

6. Payment by Cryptocurrency (in Many Cases)

Cryptocurrency has gained popularity for its decentralized and secure transactions, but it’s still not widely accepted by many online retailers. Although certain sites accept Bitcoin and other cryptocurrencies, it’s far from universal.

Why Cryptocurrency Isn’t Always Accepted:

- Cryptocurrency values fluctuate significantly, which can be risky for retailers.

- Processing times and transaction fees may vary depending on the network.

Alternative: If cryptocurrency isn’t accepted, consider using a digital wallet or prepaid credit card linked to your cryptocurrency account. Some services, like Coinbase, allow you to spend cryptocurrency via linked debit cards.

7. Certain Prepaid Debit Cards

While prepaid debit cards are generally accepted, some cards may have restrictions that prevent online use. Some cards are designed only for in-person transactions or don’t support the online authentication required for secure payments.

Why Some Prepaid Debit Cards Aren’t Accepted Online:

- Lack of verification features such as a CVV (card verification value) can limit their usability online.

- Certain prepaid cards are only activated for specific uses, like travel or gift purposes.

Alternative: Choose a prepaid debit card specifically labeled for online shopping, or check with the card issuer to confirm its compatibility with e-commerce platforms.

Leave a Reply